Requirements for publishing Nigerian loan apps on Google Play Store

While there are many options, only two stores compete. Today, let's explore the requirements of one of them: Google Play Store.

How to spot risky loan guarantors and protect yourself as a lender

A loan guarantor is basically like a secondary borrower. If they can't pay up when the borrower defaults, then having them as a guarantor is pointless.

6 practical tips to reduce loan processing times

Fast loan processing doesn’t mean approving all loan requests, but deciding if a loan should be approved or not shouldn’t take forever.

What collateral do you need to protect your loan business?

Lenders need to be smart about what kind of collateral they accept, but they also want to make sure that all sorts of businesses and people have a chance to get the loans they need to grow.

How to use Route Mobile with Lendsqr for sending SMS

Once you have your Route Mobile API key, log in to your Lendsqr account. Reach out to our product support team at support@lendsqr.com and get set up in 10 minutes.

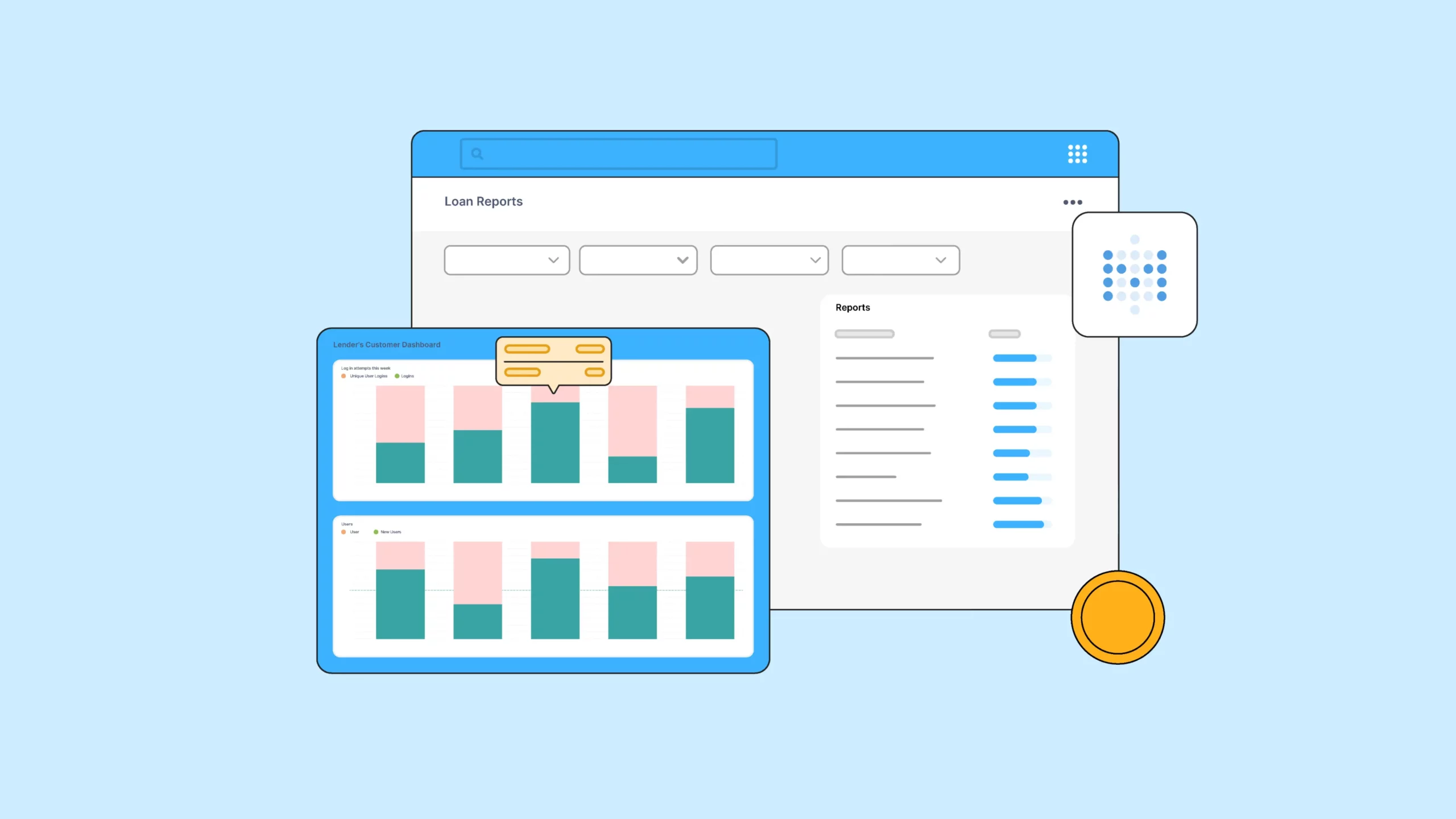

How we use Metabase to power our internal reporting

Metabase team deserves immense credit and we, at Lendsqr, are incredibly grateful to them. Their open-source platform is one of the best things we've ever gotten for free from the open source world.

How to use Infobip with Lendsqr as an SMS provider

Lenders can enjoy the best of both worlds: Lendsqr's powerful loan management software combined with Infobip's superior SMS infrastructure.

Indicina vs Lendsqr: Which loan management platform suits your needs?

With many options available in the market, two prominent loan management platforms that often stand out are Indicina and Lendsqr. Learn more about them.

7 effective debt collection practices and legal considerations

When you choose effective debt collection practices, treat debtors with respect and adhere to the law, you're more likely to collect what you're owed.

The need for financial models to build a successful loan business

Financial models perform as business GPS for lenders to avoid roadblocks and predict financial performance. But there are more ways they empower lenders.

How to use Lendsqr for distributor financing

Distributor financing bridges the gap between manufacturers, suppliers, and distributors, accelerating trade and value creation. Lendsqr secures that bridge.